Webinar series

Around 1 in 4 Australians have experienced sexual abuse as a child (Australian Child Maltreatment Study, 2023) and with rapid technological advancements, perpetrators are always finding new ways to exploit financial services to harm children. This crisis demands action, and banks are uniquely positioned to lead the fight against child sexual exploitation and abuse (CSEA).

Join us for our new multi-part online event series, Empowering every bank: Detecting and disrupting child sexual exploitation and abuse, which will equip small and mid-sized banks with the knowledge and tools to prevent, detect, and report CSEA. These webinars aim to enhance your awareness and understanding of the crime type, offering financially relevant insights, case study examples, and actionable strategies to strengthen your organisation’s response.

This series focuses on the unique challenges faced by small and mid-sized banks, although professionals from other financial institutions are welcome to attend. Together, we can strengthen industry efforts, lead prevention and detection initiatives in the corporate sector, and protect society’s most vulnerable – our children.

Audience

This event series is designed for small and mid-sized banks. However, risk managers, compliance officers, anti-money laundering (AML) professionals, and key business decision makers from any financial institution are also welcome to register.

If you are unsure if these webinars are for you, feel free to contact us at event@icmec.org.au.

Event details

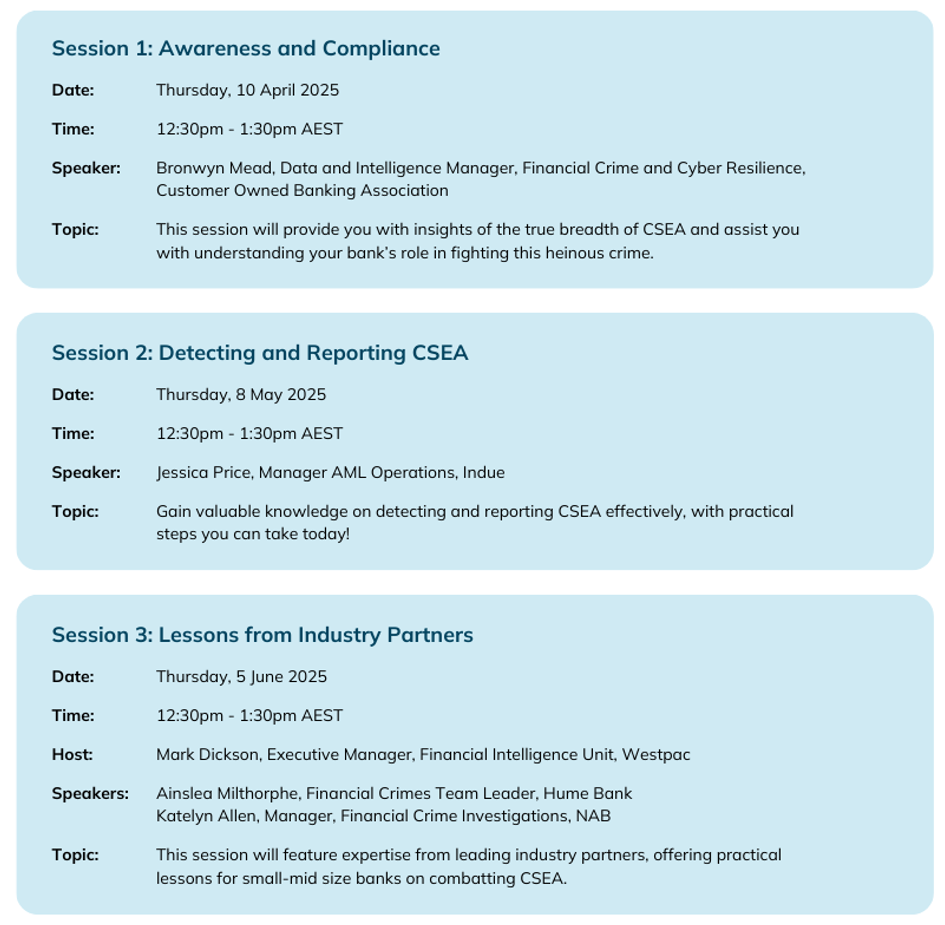

This series includes three sessions held virtually via Microsoft Teams.

Your Speakers

Bronwyn Mead Data and Intelligence Manager, Financial Crime and Cyber Resilience, Customer Owned Banking Association

Bronwyn has over 20 years of experience in the financial crime space. In addition to her operational experience with fraud, scams, and AML/CTF in the customer-owned banking sector, she is a Certified Fraud Examiner, and holds a Master of Fraud & Financial Crime. She is passionate about the value of the mutual sector, and keen to see uplift in the industry.

Her role at COBA is in data and intelligence, and she knows first-hand the challenges the sector faces in relation to financial crime, legacy systems, and capacity

Jessica Price Manager AML Operations, Indue

Jessica Price is an experienced AML professional with over eight years in financial crime, specialising in transaction monitoring, investigations, and regulatory reporting. As Manager of AML Operations at Indue Ltd, they oversee a transaction monitoring service for multiple financial institutions, helping clients strengthen their defences against evolving ML/TF threats.

With a strong operational background, they have built and trained transaction monitoring teams and understand the importance of robust processes in detecting and disrupting financial crime before it causes harm.

Mark Dickson Executive Manager, Financial Intelligence Unit

Mark Dickson is a financial crime risk and compliance specialist. He has worked in financial crime related roles at the Westpac Group for over 16 years and currently leads the Financial Intelligence Unit (FIU) function within Group Financial Crime.

Mark is passionate about collaborating with stakeholders to lead the fight against child sexual exploitation and his teams actively partner with AUSTRAC, the Fintel Alliance, law enforcement and ICMEC Australia to promote child protection initiatives.

Katelyn Allen, Manager, Financial Crime Investigations, NAB

Katelyn Allen is a Manager in the Financial Crime Investigations team at NAB, focusing on high risk investigations and public-private collaboration. Katelyn has a strong passion for protecting vulnerable people and has dedicated much of her career to combatting child exploitation.

As part of this commitment, Katelyn has developed industry leading resources and initiatives to help the financial services industry respond more effectively to child exploitation.

Ainslea Milthorpe, Financial Crimes Team Lead, Hume Bank

Ainslea Milthorpe is the Financial Crimes Team Lead at Hume Bank, bringing over 11 years of experience in the financial services industry, with a specialised focus on financial crime including fraud/scams, ML/TF and sanctions.

Ainslea is passionate about protecting and educating the community and believes that collaboration through intelligence sharing and trust are the key to success in combating financial crime.

Registration

Registrations for this webinar series have now closed.

For more details on ICMEC Australia's events, visit our industry events page below.

ICMEC Australia acknowledges Traditional Owners throughout Australia and their continuing connection to lands, waters and communities. We pay our respects to Aboriginal and Torres Strait Islanders, and Elders past and present.